Why is it important to review your bank statement each month?

Why is it important to review your bank statement each month?

Have you ever wondered how a simple habit can transform your entire financial outlook? In today’s fast-paced world, many of us tend to overlook the importance of taking a few moments every month to review your bank statement each month. But why is this monthly ritual so crucial? It might seem like a mundane task, yet this habit is the gateway to enhanced financial security, effective budgeting, and even the detection of fraud before it becomes a major issue.

When you review your bank statement each month, you gain a clear picture of your spending habits, spot any discrepancies early on, and adjust your budget accordingly. I remember the first time I dedicated an evening to go over my statement—it was eye-opening. I noticed a few charges I hadn’t recognized, which turned out to be mistakes that could have cost me dearly if left unchecked. This simple practice has helped me stay on top of my finances, avoid unnecessary fees, and even catch potential fraudulent activities in time.

So, are you ready to dive into the details and empower yourself with the knowledge and tools to take control of your financial destiny? Let’s explore why it is so important to review your bank statement each month and how you can use this habit to unlock a brighter financial future.

Understanding the Importance of Reviewing Your Bank Statement Each Month

Reviewing your bank statement each month is not merely about checking numbers on a screen; it is about understanding every aspect of your money flow. By setting aside time to analyze your statement, you build a habit of financial mindfulness that can lead to better spending decisions and overall economic well-being.

When you review your bank statement each month, you are actively involved in your financial health. This process can help you:

- Detect any unusual transactions: Mistakes or fraudulent charges can be identified quickly.

- Understand your spending patterns: You learn where your money goes, helping you adjust your lifestyle or budget.

- Monitor bank fees and charges: Unexpected fees might be hidden in your statement, and recognizing them allows you to take corrective measures.

- Prepare for upcoming expenses: By keeping a close watch, you can plan for future payments, emergencies, or even savings goals.

This monthly ritual isn’t just about the numbers—it’s about cultivating an attitude of responsibility and control over your personal finances. The more you engage with your bank statements, the better you can plan and secure your financial future.

Detecting Errors and Fraudulent Activities

One of the primary reasons to review your bank statement each month is the ability to detect errors and fraudulent activities. Banks are not infallible, and mistakes do happen. Whether it’s a duplicate charge, an unrecognized fee, or even a scam transaction, early detection is key.

By scrutinizing your statement every month, you may find:

- Incorrect deductions or unauthorized withdrawals.

- Signs of identity theft or fraud.

- Errors in interest calculations or misapplied payments.

In one instance, I discovered a charge on my statement that I never authorized. After reaching out to my bank immediately, the error was rectified, saving me from further complications. This personal experience reinforced the need to review your bank statement each month—it’s not just about staying informed, but also about protecting your hard-earned money.

A vigilant review can also alert you to recurring errors that might signal larger systemic issues with your bank. Therefore, dedicating time to this task not only safeguards your finances but also improves your relationship with your financial institution through open communication and accountability.

Budgeting and Financial Planning: A Closer Look at Your Spending

When you review your bank statement each month, you gain an excellent opportunity to map out your budget. It’s like a financial health check-up that allows you to see what is working and what isn’t. Reviewing your statement gives you a clear idea of:

- Where you overspend: Identifying areas where you might cut back.

- Potential savings: Recognizing opportunities to save more effectively.

- Recurring expenses: Highlighting subscriptions or services you no longer need.

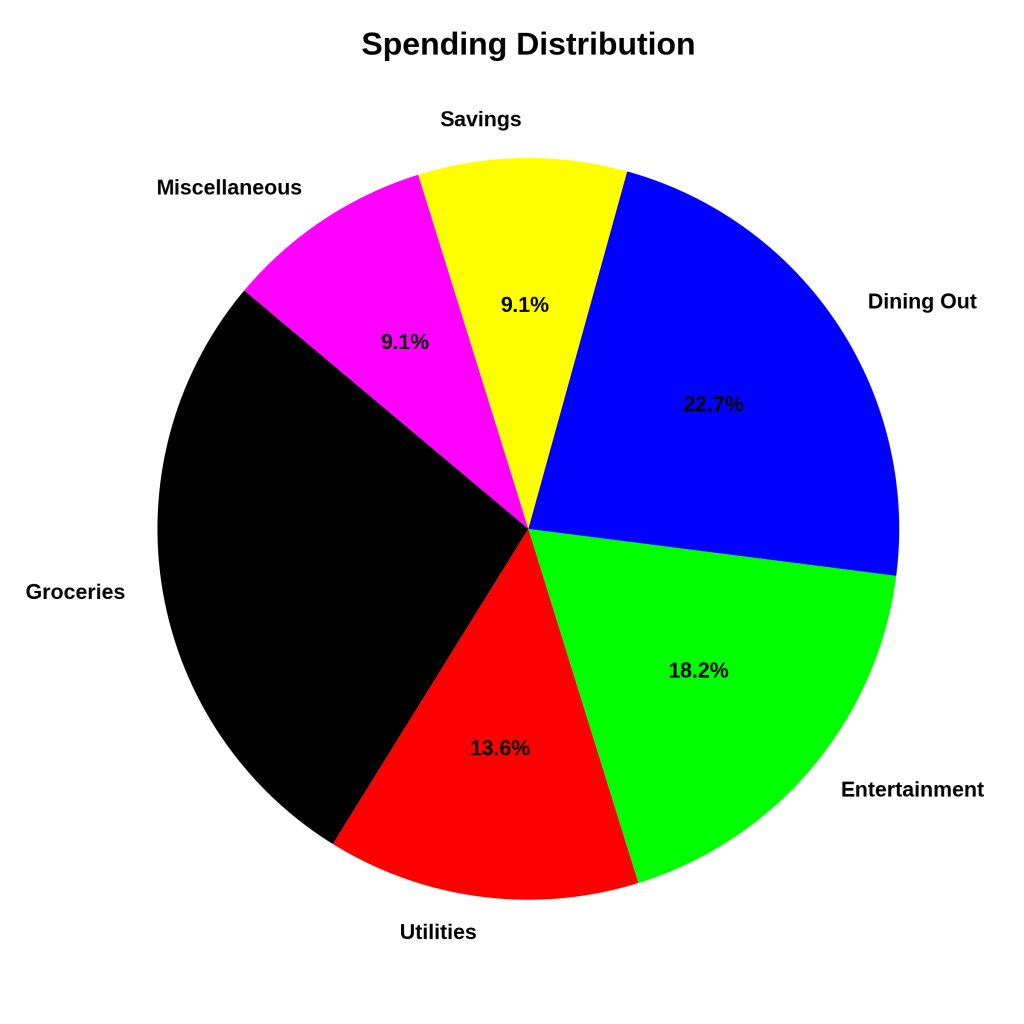

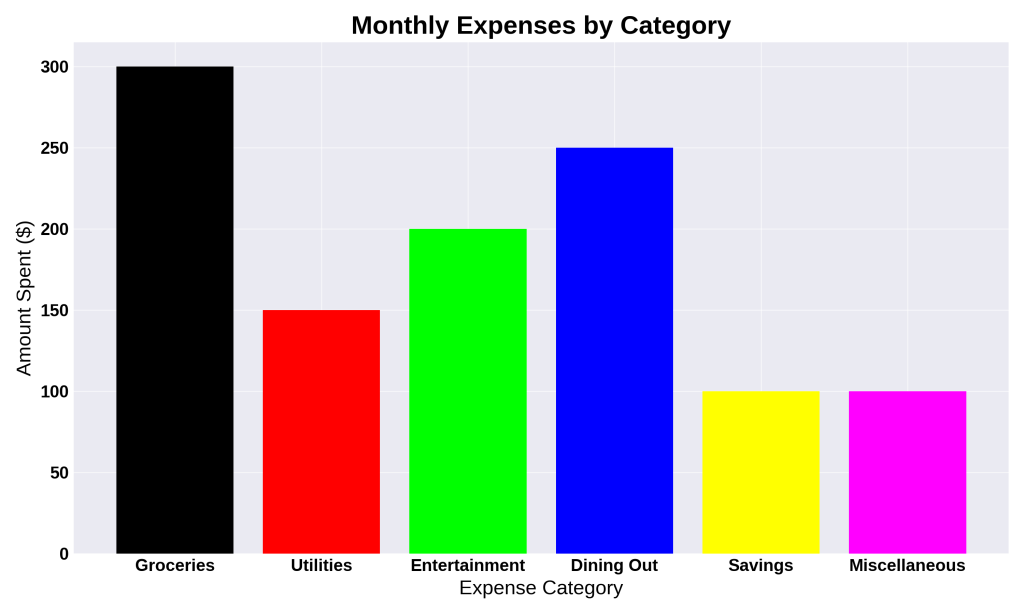

Using a simple table, you can organize your monthly expenses as follows:

| Category | Amount Spent ($) | % of Total Spending |

|---|---|---|

| Groceries | $300 | 25% |

| Utilities | $150 | 12.5% |

| Entertainment | $200 | 16.7% |

| Dining Out | $250 | 20.8% |

| Savings | $100 | 8.3% |

| Miscellaneous | $100 | 8.3% |

This simple breakdown, which you can generate from your statement review, serves as a roadmap for effective financial planning. By consistently making it a habit to review your bank statement each month, you will notice trends over time that help you forecast future expenses and allocate funds more wisely.

Uncovering Hidden Fees and Charges

Another compelling reason to review your bank statement each month is to uncover hidden fees and charges. Many banks apply fees that might not be immediately obvious. These could be:

- Monthly maintenance fees

- ATM usage fees

- Overdraft charges

Such fees may seem small at first, but they add up over time. When you take the time to inspect your bank statement, you can identify these charges, question them, and even switch to a better-suited account if necessary. I once noticed a series of small fees that collectively drained a significant portion of my monthly balance. Once identified, I was able to address the issue with my bank and find a solution that minimized those extra costs.

By making it a point to review your bank statement each month, you gain the power to hold your bank accountable. This proactive approach ensures you are not paying more than you should and that every fee is justified. Moreover, it encourages you to keep an eye on your account activity, thereby reducing the chances of overlooking any unnecessary charges.

Personal Experience: My Journey with Monthly Bank Statement Reviews

Let me share a personal story. A few years ago, I was surprised by a mysterious charge on my bank statement. I had not made any large purchases, and yet there was an unexpected debit that left me puzzled. That evening, I sat down with a cup of coffee and decided to review my bank statement each month meticulously. I compared each charge, questioned every fee, and reached out to my bank for clarification.

That night, I learned that a subscription service I had forgotten about was charging me more than I had agreed to pay. I immediately canceled the subscription and requested a refund for the extra charges. This incident not only saved me money but also taught me the invaluable lesson that regularly reviewing your bank statement can prevent future mishaps.

This experience became a turning point. I made it a habit to review your bank statement each month and soon found that I was better informed about my finances. The process gave me confidence in managing my money and opened my eyes to ways I could save. I also began to experiment with budgeting apps and financial tracking tools that further enhanced my ability to monitor my spending. This proactive approach has made my financial life much smoother and more secure.

Innovative Tools and Strategies to Enhance Your Financial Health

Today’s technology offers countless innovative tools to help you review your bank statement each month. From mobile banking apps to automated budgeting software, there are plenty of ways to simplify the process and make it more engaging. Here are a few strategies you might consider:

- Budgeting Apps: Tools like Mint, YNAB, or Personal Capital allow you to import your bank statements directly and visualize your spending patterns. These apps can even send alerts for unusual transactions.

- Spreadsheet Templates: For those who prefer a DIY approach, customized spreadsheets can help you track expenses, set budgets, and analyze trends over time.

- Digital Alerts: Set up notifications with your bank so that any unusual or large transactions are immediately brought to your attention.

- Regular Financial Check-Ups: Schedule a monthly “money date” where you sit down, review your statement, and adjust your budget accordingly.

These tools not only simplify the process of reviewing your bank statement each month but also empower you to make proactive financial decisions. Using technology in this way makes the habit less of a chore and more of an interactive, engaging experience. I have found that using these tools has transformed a once-dreaded task into something that is both productive and even enjoyable.

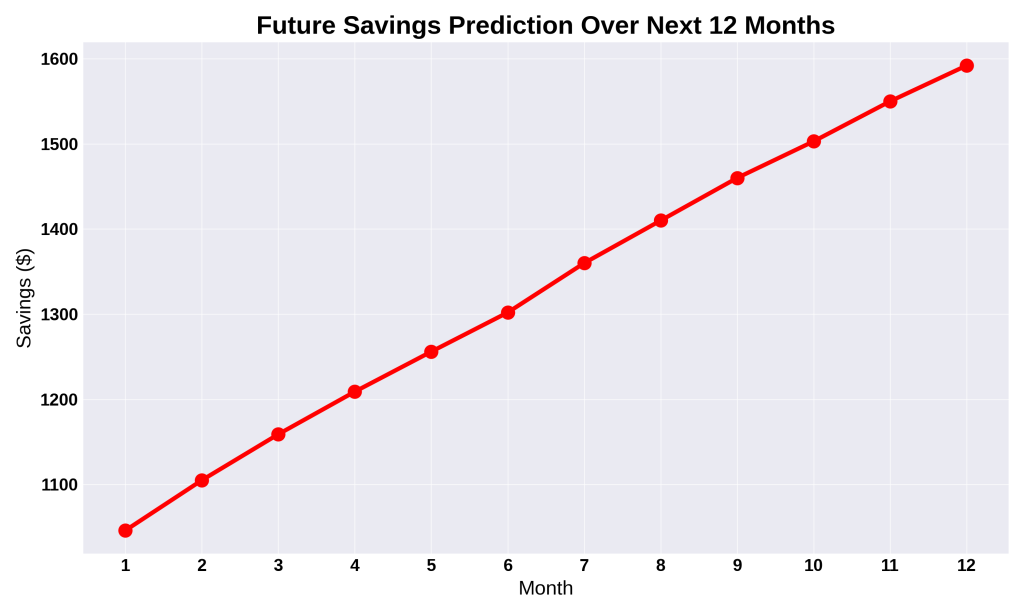

Future Trends and Predictions in Banking

Technology in banking is evolving rapidly. As more financial transactions move online, the need to review your bank statement each month becomes even more critical. In the near future, you can expect:

- Enhanced Security Protocols: With improved monitoring systems and AI-driven fraud detection, banks will become even better at protecting your money.

- Real-Time Data Access: Future banking platforms may offer real-time updates on your spending, making monthly reviews more dynamic and immediate.

- Personalized Financial Insights: Advanced analytics will provide personalized recommendations, helping you save and invest smarter.

- Integration with FinTech Innovations: Expect more seamless integration with budgeting tools, digital wallets, and even cryptocurrencies.

These advancements mean that the act of reviewing your bank statement each month will only become more beneficial. Not only will it help you stay on top of your finances today, but it will also prepare you for a future where your money is more secure and your financial decisions are more informed. Embracing these trends early on sets you on the path to financial resilience and prosperity.

Practical Tips to Get Started with Your Monthly Review

If you’re wondering how to begin, here are some practical tips to make the process of reviewing your bank statement each month both effective and enjoyable:

- Schedule a Fixed Day: Choose a day every month when you have some quiet time—perhaps the first weekend of the month—to go through your statement.

- Use a Checklist: Create a checklist of items to review, including transactions, fees, and spending categories. This ensures you don’t miss any details.

- Leverage Technology: Download a budgeting app or create a simple spreadsheet to track your expenses.

- Stay Organized: Keep digital or physical copies of your monthly statements for future reference.

- Ask for Help: If you’re not comfortable with numbers or find errors hard to understand, don’t hesitate to call your bank for clarification.

- Reward Yourself: Recognize your progress by treating yourself (within budget limits) when you complete your review without finding any issues.

By following these strategies, you can build a solid habit that not only ensures accuracy but also gives you confidence in your financial management skills. Remember, the simple act to review your bank statement each month can lead to powerful, positive changes in your financial life.

Taking control of your finances starts with a single step: make sure to review your bank statement each month. A little vigilance can lead to big rewards! #MoneyMatters

— Jane Doe (@JaneFinance) March 10, 2025

Bringing It All Together

Regularly choosing to review your bank statement each month is more than just a routine; it is an empowering habit that builds financial literacy, improves security, and lays the groundwork for a stable future. By taking the time to analyze every transaction, question every fee, and use modern tools to track your spending, you actively participate in your own financial well-being.

My journey began with a single glance at my statement one quiet evening and grew into a full-blown habit that saved me from costly errors, increased my awareness, and even sparked a passion for budgeting and personal finance. With the help of innovative apps and data visualizations, I transformed a simple monthly task into a dynamic part of my financial strategy.

Whether you are new to budgeting or an experienced saver, remember that the practice to review your bank statement each month is a small but powerful step towards financial freedom. As you see your data laid out in charts and tables, as you connect with others via social media, and as you witness trends that shape the future of banking, you become an active participant in your own economic success.

Future-Proofing Your Financial Strategy

As we move further into the digital age, the way we manage money is evolving. Financial institutions are incorporating artificial intelligence, blockchain, and real-time data analytics into everyday banking. This means that your monthly routine to review your bank statement each month will soon be complemented by even more advanced tools that predict spending trends, alert you to potential risks, and help you optimize your savings.

Imagine a future where your bank statement review isn’t just a static document but a dynamic dashboard that shows your financial health in real time. By embracing these changes now, you set yourself up for success in the coming years. Your proactive approach today is the foundation for a secure financial future tomorrow.

Conclusion: Taking Control of Your Finances

To sum up, the decision to review your bank statement each month is an essential part of modern financial management. It protects you from errors, uncovers hidden fees, provides a clear view of your spending, and even acts as a springboard for advanced financial planning. My personal experience taught me that a few hours of thoughtful review each month can save you time, money, and stress in the long run.

By adopting this practice, you join a community of proactive savers who are not afraid to take control of their financial destiny. So, why wait? Start today, embrace the habit, and watch as your financial future becomes clearer, safer, and more promising.